Today, we’re going to talk about the importance of understanding something that most businesses overlook— Customer Lifetime Value (CLV).

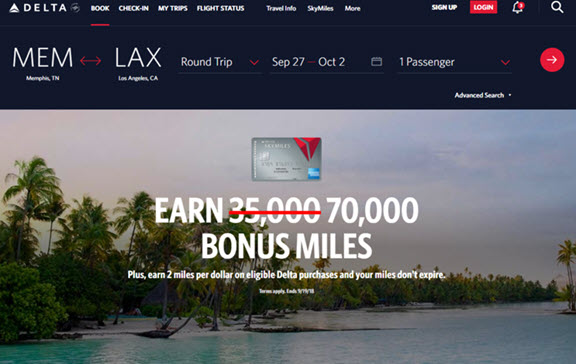

Before I begin, allow me to first start with an illustration. Please look at the image below.

When I fly, I prefer to fly with Delta Airlines.

Recently, I needed to take a flight from Memphis, TN to Los Angeles, CA, for a conference that I was considering. So, as usual, I began researching a flight on their website.

The above image was on Delta.com’s landing page. It shows that Delta is offering it’s customers 70,000 bonus miles, twice as many miles as they normally offer, if those customers sign up for Delta’s American Express credit card.

On the surface, Delta Airlines is in the airline business, and therefore you would think they should only concentrate their efforts to get more customers on their airplanes, instead of getting customers to sign up for a credit card offer.

On the outside looking in, Delta’s core offer is a service that shuttles customers to and from different destinations around the world in airplanes. But, you must remind yourself that any business that it’s the business of making money is really in the “growth business.”

There are only three ways for a business to grow:

- You can increase the number of customers

- You can increase the average transaction value per customer

- You can increase the frequency of each customer’s transaction

Knowing this, why would a company that’s in the business of shuttling customers in airplanes want to promote credit cards on their home page?

Let’s investigate further.

The 70,000 airline miles is the equivalent of approximately $700, if you do the math. This is enough for an international round trip flight, or the equivalent of two round-trip domestic flights. Who wouldn’t want to sign up?

Delta airlines is willing to run a promotion that effectively gives $700 away for “free” to someone like me and to credit card churners. A credit card churner is someone who applies for credit cards, and after meeting the spend limit, reap the rewards of the cards without ever paying a cent of interest.

So, again, why would Delta want to promote a $700 giveaway to someone who’s not going pay them any money in interest on their cards?

Well, if you think about it, a credit card is a perfect revenue generation strategy for Delta, even if they don’t get a cent of interest from their credit card holders.

Delta airlines can easily give away $700 to each customer because they’re smart enough to understand their customer’s lifetime value (CLV).

What is customer lifetime value (CLV)?

Your customer’s lifetime value is a quick, but rough estimate of the predicted revenue that each of your customers will bring into your business. Every business must know this number, because it should be the prime driver for many, if not all, of your business’s financial decisions.

The Customer Lifetime Value allows you to 1) know how much you can spend to acquire a customer, 2) make decisions on whether or not you’ll continue to service or retain a customer, and 3) determine what type of value ladder to map out for your customers.

How do you calculate the Customer Lifetime Value (CLV)?

To determine your Customer’s Lifetime Value (CLV), you take the average profit per customer, multiple it by the number of times the customer purchases over a year, and then multiple that by the number of years your customer purchases from you.

CLV = Average profit per customer × # of customer purchases × # of years of customer retention

For example, if on average you make $100 in profit every time one of your customers buy something from you, and they purchase once per month for any entire year, they’re worth $1,200 a year to you. If your customers continue to make purchases for five years, on average, then your customers, in total, are really worth $6,000 ($1,200 per year × 5 years) to you. This would be your customer’s lifetime value.

So, what does this really mean for you?

If you know that someone who becomes your customer will provide you with $6,000 in profit over the next five year period, in theory, you can spend up to $6,000 in promotions or advertising to acquire and keep this person as a customer and you’ll still technically be profitable.

If you’re not comfortable projecting out to a five year period, you can use a one year time frame as the value to use. So in this example, the customer will provide $1,200 in yearly profit to your business. Which means, you can spend up to $1,200 in promotions or advertising to acquire and keep this customer.

Now, back to Delta.

Let’s say once Delta “hooks” a new customer with this offer, they use their 70,000 miles for a flight, and afterwards the customer has a great experience. If the customer becomes a loyal fan (like me) and only prefer to fly Delta in the future, the customer’s lifetime value becomes infinite to Delta, even if they don’t pay a cent of interest on the credit card.

Delta gives perks to its credit card holders, effectively enticing its customers to continue to “buy Delta.” They give double miles for flights and discounts for in-flight purchases.

For the sake of this example, though, let’s say the customer is worth $500 in profit for every flight.

If the customer takes on average four flights per year, at an average profit to Delta at $500 per flight for the next five years, Delta can calculate this customer’s lifetime value.

CLV of a Delta customer = $500 per flight × 4 flights per year × 5 years = $10,000.

Once customer is worth $10,000 to Delta in this scenario. This means that Delta pays $700 to acquire a customer, but will end up getting $10,000 in future profit from the customer.

This is a very conservative estimate.

If you assume that the customer takes 8 flights per year over the next five years, the value of the customer doubles to $20,000. And if the customer takes one flight per month over the next five years, Delta will collect $30,000.

Can you see the power of knowing your customer’s lifetime value? The great news is that CRM software easily allows you to seamlessly track each of your customer’s lifetime value.

How to Increase Your Customer’s Lifetime Value to Increase the Growth of Your Business

Improving your Customer Lifetime Value directly feeds into two of the three ways to grow your business. Earlier, I stated the three ways to grow your business, which are:

- You can increase the number of customers

- You can increase the average transaction value per customer

- You can increase the frequency of each customer’s transaction

You can raise your prices or offer different products to increase your average transaction per customer

If Delta raised their prices by just 10%, this automatically adjusts the average transaction value per customer by 10%. This increases the customer lifetime value from $10,000 to $11,000, and automatically increases the profit Delta can use to acquire even more customers.

However, Delta would have to be careful not to abruptly make any price changes to prevent customers from switching to competitors. So, another way to increase the average transaction cost is to offer supplementary products. They do this by offering premium seating prices for Delta comfort, Business Class, First Class, and exit row seating. They also offering travel insurance.

You can offer more promotions to increase the frequency of each of your customer’s purchases.

Delta introduces more ways that each customer can purchase more times (like running flight promotions via email), which can entice a customer to take 6 flights per year, instead of 5.

You can increase the number of customers by reinvesting

As you increase your customer’s lifetime value, your business will receive more profit that can be used to acquire more customers. In our Delta example, let’s say they reinvested the $10,000 CLV from just 1 of the customers. This allows them to acquire approximately 14 more customers ($10,000 ÷ 700).

In other words, 1 customer that’s worth $10,000 gives Delta the ability to acquire 14 more customers. This can bring Delta $140,000 in profit over the next five years!

Now that’s how you grow a business!